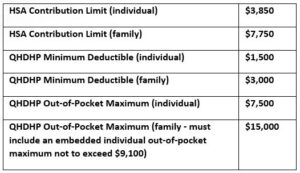

HSA Limits for 2023

IRS Revenue Procedure 2022-24 updated the limits for qualified high deductible health plans (QHDHPs) for plan years beginning in 2023 as well as the 2023 calendar year health savings account (HSA) contribution limits, as set forth below:

For non-grandfathered health plans that are not QHDHPs, the out-of-pocket maximums for plan years beginning in 2023 are $9,100 (individual) and $18,200 (family – must include an embedded individual out-of-pocket maximum not to exceed $9,100).

Compliance with ACA Contraceptive Mandate

The ACA requires non-grandfathered group health plans and insurers to cover without cost-sharing at least one form of contraception in each FDA-identified contraceptive category, as well as contraceptive services and FDA-approved, cleared or granted contraceptive products that an individual and their attending health care provider have determined to be medically appropriate for the individual. Health plans and insurers may use reasonable medical management techniques as long as there is an accessible, transparent and sufficiently expedient exceptions process that defers to the attending provider’s recommendations.

In response to complaints and reports of non-compliance, the DOL, HHS and Treasury have jointly issued a warning letter to health plan sponsors and insurance carriers to make sure that they fully comply with the contraceptive coverage mandate. The agencies are actively investigating compliance and may take enforcement or other corrective action against health plans or insurers that do not comply. The letter outlines steps that should be taken, including:

- developing an appropriate exceptions process

- using standard forms and instructions for exceptions

- providing information about the availability of and process for exceptions in plan documents and online resources

- eliminating non-compliant medical management practices

HHS issues Proposed Regulation Under Section 1557 of the ACA

Section 1557 of the ACA prohibits discrimination on the basis of race, color, national origin, sex, age, or disability in certain health programs or activities. Its stated objective is to ensure individuals can access health care free from discrimination.

The new proposed regulation is intended to restore and strengthen civil rights protections for patients in certain federally funded health programs and HHS programs after the 2020 version of the rule (issued by the prior administration) limited the scope of Section 1557. It addresses the following:

- reinstates the scope of Section 1557 to cover HHS health programs and activities

- clarifies the application of Section 1557 nondiscrimination requirements to health insurers that receive federal financial assistance

- aligns regulatory requirements with Federal court opinions to prohibit discrimination on the basis of sex, including sexual orientation and gender identity

- makes clear that discrimination on the basis of sex includes discrimination on the basis of pregnancy or related conditions, including pregnancy termination

- requires entities to give staff training on language assistance services for individuals with limited English proficiency (LEP), and on reasonable modifications to policies and procedures for people with disabilities

- requires covered entities to provide a notice of non- discrimination along with a notice of the availability of language assistance and auxiliary aids and services

- clarifies that nondiscrimination requirements applicable to health programs and activities include those services offered via telehealth, which must be accessible to LEP individuals and individuals with disabilities.

- interprets Medicare Part B as federal financial assistance

- refines and strengthens the process for raising conscience and religious freedom objections

HHS is encouraging all stakeholders, including patients and their families, health insurers, health care providers, health care professional associations, and consumer advocates to submit comments on the proposed regulation.

Delaware Passes Paid Family Leave Law

Delaware recently passed the Healthy Delaware Families Act, which provides paid leave for parental, medical and caregiving reasons. Contributions begin January 1, 2025 and benefits begin January 1, 2026. The required contributions will be:

- for parental leave, the rate is .32% of wages

- for medical leave, the rate is .4% of wages

- for family caregiving leave, the rate is .08% of wages

Employers with at least 10 employees in the state must contribute to the program and provide parental leave. Employers with at least 25 employees in the state must also provide family caregiving and medical leave and contribute to those programs. Employers may deduct up to 50% of the total contribution from employees. Employers can use a private plan to satisfy the requirements of the paid family leave law.

Employees are eligible for up to 12 weeks of parental leave, 6 weeks of family caregiver leave, or 6 weeks of medical leave in an application year. Employees are limited overall to 12 weeks of benefits in a single application year and 6 weeks of medical and/or family caregiving leave in any 24-month period.

The weekly benefit beginning in 2026 is 80% of the individual’s average weekly wages. The maximum weekly benefit for 2026 and 2027 is $900. The law requires that employees be provided with benefit continuation and job restoration in the same manner as leave taken under FMLA.

Recent Changes to DC’s Universal Paid Leave (UPL)

DC has made several enhancements to its UPL, including:

- Elimination of one week waiting period for benefits

- Permanent prohibition on benefit offset by disability carriers, which means that eligible employees may receive more than 100% of wages while on leave

- Decrease in employer contribution rate to .26% of wages (from .62%) beginning in the 3rd quarter of 2022

- Increase in the maximum benefit durations beginning in the 4th quarter of 2022: 12 workweeks for medical leave, parental leave and family leave