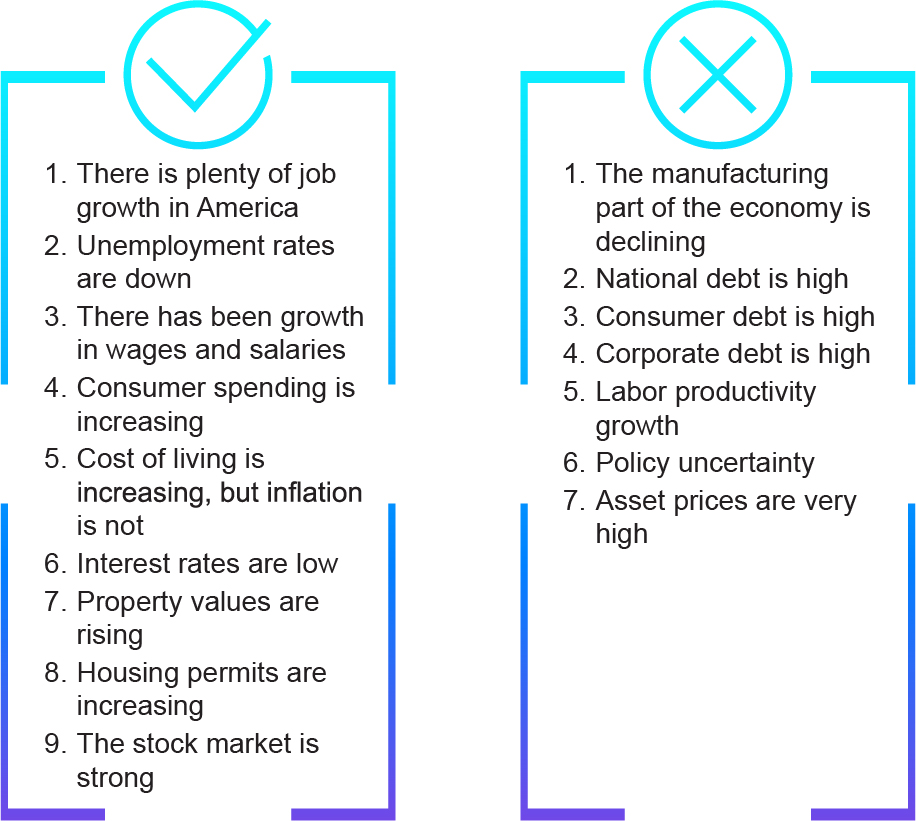

PSA recently hosted a seminar and panel discussion in partnership with the Regional Manufacturing Institute of Maryland (RMI) at which expert economist Anirban Basu discussed the future of Maryland manufacturing as it relates to the state of the U.S. economy. In 2019, and against all odds, the U.S. economy experienced low inflation levels and low interest rates—our economy is going strong. As we look ahead, Anirban shared some positive and negative trends in the current U.S. economy, and ultimately provided a prediction for the next 12–18 months. Read on to learn Anirban’s insights into the U.S. economy as it relates to manufacturing and adjust your strategies now to save money and protect your business.

12–18-month U.S. economy forecast

According to Anirban’s assessment of these signs, risk of recession is elevated due to the impending election. Additionally, U.S. manufacturing activity is still sluggish, though the pending trade agreement with China could set the stage for resurgence—especially in the US farming sector. Ultimately, his recommendation was that businesses should be raising cash while profits are high, and business is strong. Make sure your line of credit is large enough and consult your trusted financial partners to evaluate your unique situation.

What should I do?

Consider the state of your business. Take the time to look at your overarching financials and strategies at a bird’s-eye-view. Have you grown, downsized, or been part of a merger? Has your business undergone any major changes in operations that might mean your policies and protections need to change along with them? The time to act and make appropriate changes is now, while business is good. There could be potential cost-savings found if your circumstances have changed, or you might find you have unprotected exposures you didn’t even think about.

With all this information about state of economy and many new technological developments in the manufacturing field (such as Industry 4.0), when was the last time you evaluated your cyber liability exposure, and what (if anything) are you doing to protect your business? Do you have a broker partner who periodically revisits your policies to ensure coverages aren’t outdated and you’re taking advantage of all possible credits and cost-saving opportunities?

If you’d like an in-depth analysis of your policies, safety procedures, and cyber liability controls, or you have questions about how broker services can help your business, contact me at emoles@psafinancial.com.