You might be surprised to know that everyone in the United States, according to standards set by the Federal Emergency Management Agency (FEMA), lives in a flood zone. The agency classifies the country into three risk categories: low, moderate, and high.

But living outside of the high-risk areas doesn’t mean you shouldn’t be prepared for a flood and consider some measure of flood insurance. In fact, according to the National Flood Insurance Program (NFIP), about 25 percent of NFIP flood claims come from people who live in moderate to low risk areas. The NFIP also reports that more than 30 percent of flood-related Federal Disaster Assistance goes to people outside of high risk areas.

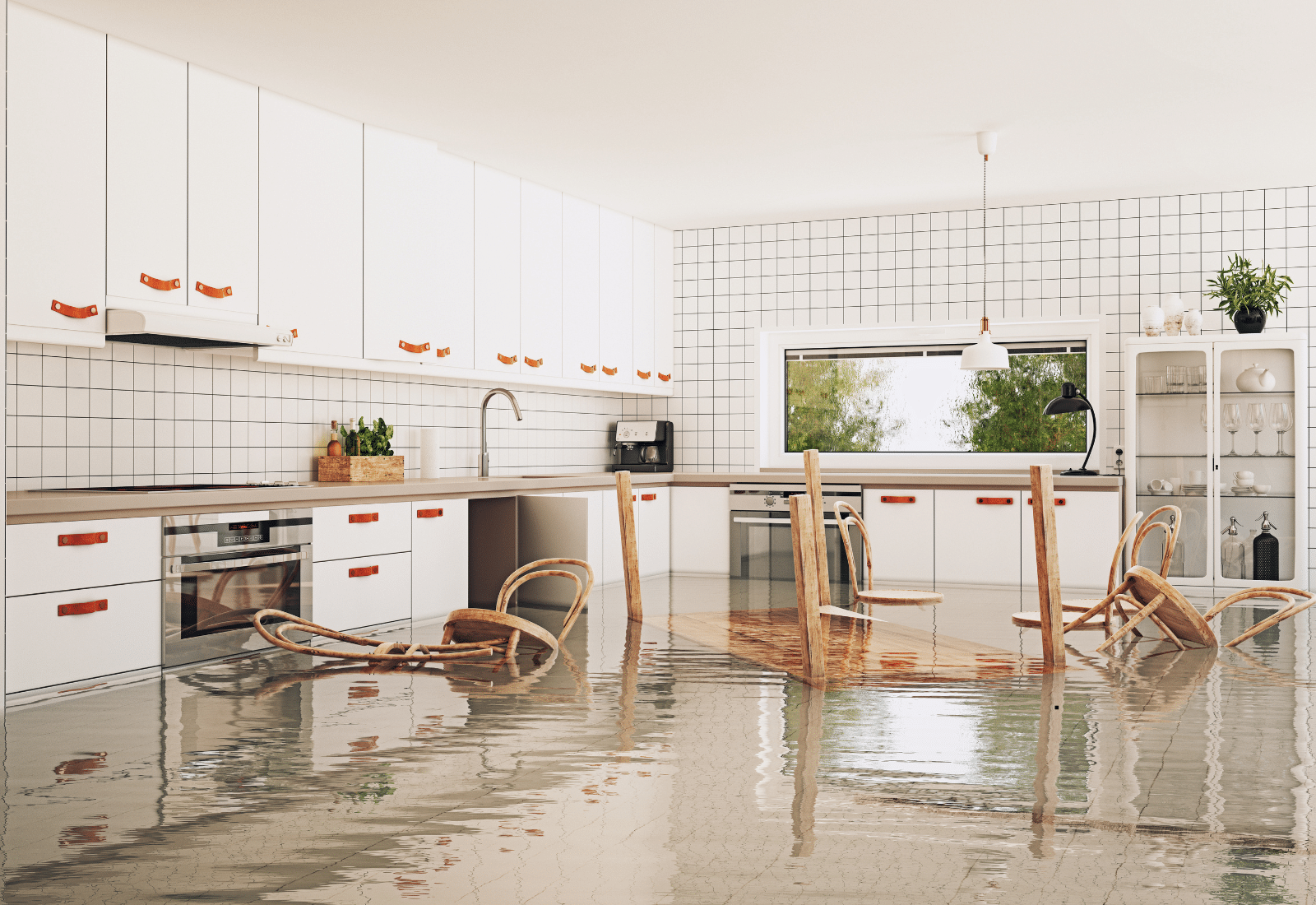

There are a number of things you can do in and around your home, including buying flood insurance, to best prepare for the possibility of flooding.

Flood Prep

The Insurance Institute for Business and Home Safety has some great tips for evaluating your home and property. There are several big ticket items on the list, like making sure the grading in your yard leads water away from the house, and hiring a licensed electrician to raise all electrical connections at least a foot above the expected flood level in your neighborhood.

There are also simple things you can do, whether a storm, such as a hurricane, or flood is imminent or you just want to be prepared for the future. These include making sure drains and gutters are free from debris; preparing an evacuation kit with important papers, medications, phone chargers, and a supply of water and non-perishable food; and – if it looks like a flood is coming – shutting off the main breaker in your house.

It also makes sense to conduct a household inventory (with photographs, serial numbers, etc.), which will be crucial should you need to file an insurance claim.

During a flood, it’s best to get to higher ground. Never try to walk across flowing streams or drive through flooded roadways, and keep a battery-powered radio at hand so you can keep up to date on emergency announcements. And, it’s always better – should your home become flooded – to move to a higher floor rather than evacuate.

After a flood, call your insurance agent, take photos to document any flood damage, and make a list of damaged or lost items. Keep the power turned off until an electrician certifies it’s safe to turn it back on, and boil drinking water until the authorities declare it safe to drink.

Mechanical Readiness

If you have a sump pump in your basement, invest in a sump pump battery backup. This backup will kick in when the power goes out, which will prevent your sump pump from backing up into the basement.

If you live in a low-lying area, consider having a plumber install a sewage backflow preventer on your sewage line. Flash flooding can cause backups in sewer lines, which can then put pressure on the pipe that carries waste water out of your house. A backflow preventer does exactly what the name implies: prevents dirty water from flowing the wrong way and spilling out of a laundry tub or other opening into your house.

While you are at it, have your appliance maintenance professional double check that the pressure release valve on your hot water heater is in good working condition. A faulty valve, or an aging tank with a rusty bottom, can lead to flooding. The release valve is designed to blow open if there’s a big spike in the water pressure, and it should be connected to a laundry tub or other outlet so that, if the valve blows open, the water has some place to go.

Purchase Flood Insurance

There are several options when considering a flood policy. A Building Property flood policy may cover a building’s structure along with electrical and plumbing systems, the air-conditioning unit, furnace, water heater, and other appliances, and removal of debris. A Personal Property flood policy may cover clothing, furniture, curtains, electronics, portable appliances, certain valuables such as original artwork, and furs. Items not typically covered by flood insurance include moisture-related damage that could have been prevented by the owner, currency, jewelry, property outside of the building, such as septic systems, decks, fences, swimming pools as well as living expenses such as temporary housing.

Flood insurance coverage rates and policy limits will depend on a variety of factors, so it always makes sense to proactively set those variables to help manage your risks and cost.

For more information on flood insurance, or flood prevention, please feel free to contact PSA, or email EAzwalinsky@psafinancial.com.