In the United States, catalytic converter thefts have increased 1750% since 2019, but we are experiencing another spike in thefts due to the Russia – Ukraine conflict. Since Russia is one of the top exporters of the precious metals used in catalytic converters – rhodium, palladium and platinum – there’s a shortage of these valuable metals on the black market driving their prices up beyond the price of gold. For instance, rhodium is sold for $14,500 per ounce, palladium is $2,336 per ounce and platinum is $1,061 per ounce as of the date of this blog.

Although California, Texas and Illinois are the top states with the most theft claims, the increase in catalytic converter thefts is occurring nationwide, and it can be quite costly for you to get a catalytic converter replacement, which can range from $800 to $4,000 depending on the year, make and model of vehicle. So, in this blog, I’d like to discuss some catalytic converter theft prevention best practices to reduce your risk and help you structure your insurance policy to protect your vehicles and ensure your business is covered.

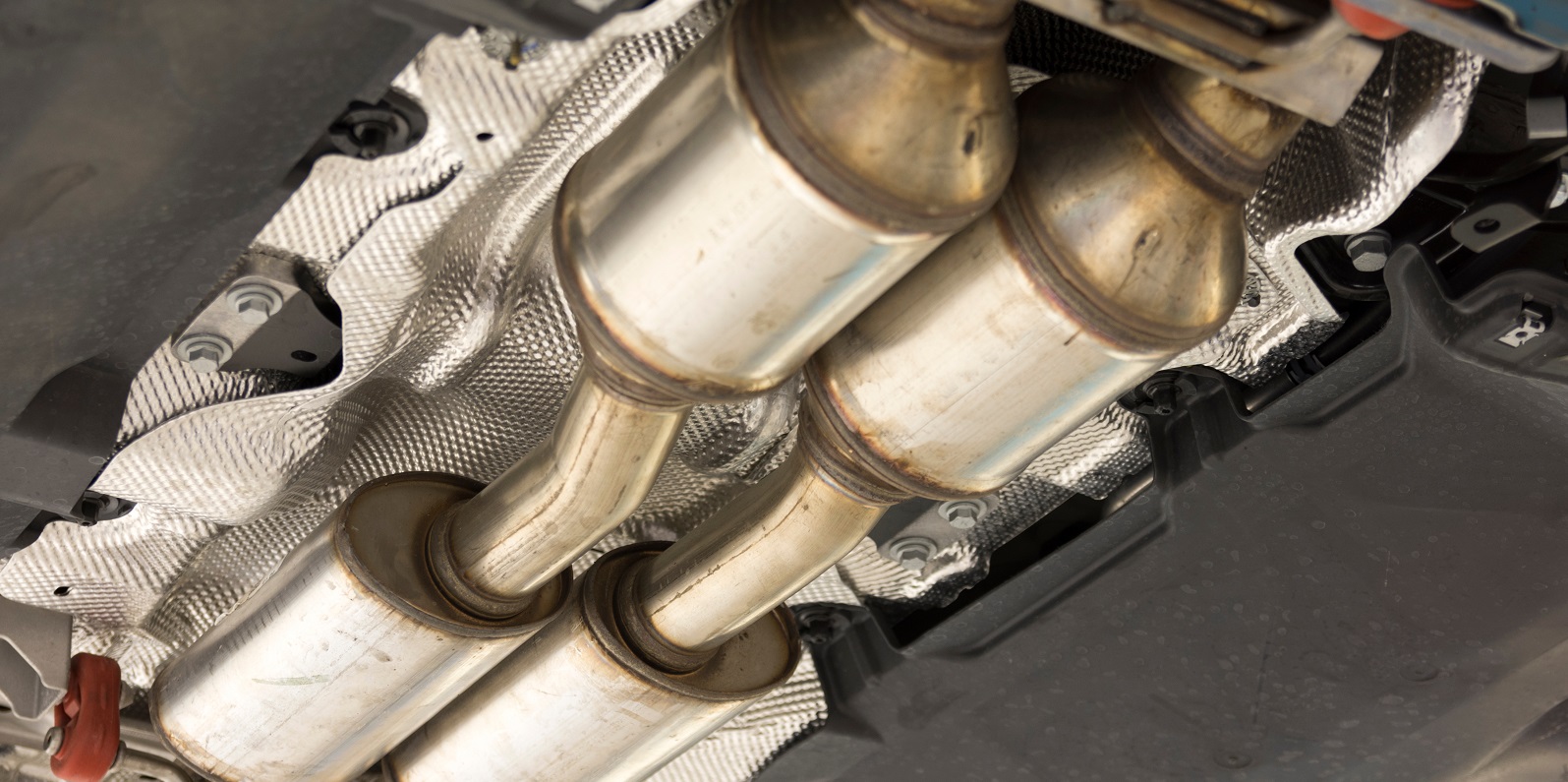

What is a Catalytic Converter?

A catalytic converter is a car part in your exhaust system to convert dangerous exhaust fumes into less harmful pollutants to the environment. Catalytic converters became popular in 1970s.

What Cars are Targeted for Catalytic Converter Theft?

While all types of vehicles are targeted, luxury, hybrid, high profile trucks, SUVs, and older vehicles are especially the favorites of criminals either due to the ease of removing catalytic converters or because the catalytic converters contain more of the precious metals. Catalytic converters can be stolen in less than a minute depending on the burglary tools a thief may have. For instance, some of the most targeted vehicles include Honda Accord, Honda CR-V, Toyota Prius, Ford F-series, Chevrolet Equinox to name a few.

Catalytic Converter Theft Prevention Best Practices

How to prevent catalytic converter theft and vandalism to vehicles in your shop? Here are several best practices you can follow:

- If you have the means or space, the best protection is to bring vehicles inside a locked garage.

- If locking every vehicle in a safe garage may not be possible for your business, here are some other ways you can protect a catalytic converter from a potential theft and vandalism on the lot. Some of these may be costly, but you should conduct a cost-benefit analysis to determine if the recommendations below would be worth your investment. For instance, if you have incurred $10,000 in theft expenses already, but the cost to implement a particular security measure is only $5,000, the investment in your company will pay for itself.

- If feasible, install a fence or increase its height to 8 feet or higher and secure the gates with heavy duty padlocks and chains.

- Enhance lighting in areas where vehicles are parked or stored.

- It has been proven that cameras are NOT effective in catalytic converter theft prevention. Instead, installing yard motion detectors, gate opening sensors or other detection devices that will trigger a burglar alarm, lights or sirens on the premises are more effective and often less expensive.

- Re-calibrate the vehicle alarm (if any) to trigger when any vibration is detected, which is typical during theft of a converter.

- Consider installing theft deterrent devices, such as an alarm, on the most high-risk vehicles (electric/hybrid vehicles and those highest off the ground).

- Retrofit existing vehicles with converter theft prevention devices and include this as part of your new vehicle acquisition process. Some commercially available products include:

- Hire security guard services to monitor your premises after hours and on weekends.

- Park against walls or areas where it is difficult to get under the vehicle.

- Limit the amount of time a customer can keep their vehicle on your lot. We understand that some vehicles need to stay while parts are ordered, but try streamlining your processes, so work is completed, and the vehicle returned to the car owner as fast as possible.

- Something new that nearly every state in the United States is working on is etching or stamping Vehicle Identification Number (VIN) or Serial Numbers on catalytic converters to prevent the resale or recycling of these units. States such as California and Illinois are currently trying to pass laws that make it illegal to be in possession of a stolen converter, which you can’t prove you own, if the Vehicle Identification Number and or Serial Number is not etched in it. Many police departments are providing free ‘etch and catch’ theft deterrent programs. The law enforcement department will etch the vehicle’s license plate or VIN number into the catalytic converter, and they will also spray a bright colored high heat durable spray paint on the converter. They will also provide the vehicle owner with a bright yellow sticker that reads “This vehicle’s catalytic converter has been etched by the XYZ Police Dept.”

- Another inexpensive and practical way for catalytic converter theft prevention is installing GPS tracking devices. While these devices in no way help protect the theft and vandalism of catalytic converters, they can be used to help track a vehicle quickly before it is destroyed or dismantled. With the advances in technology, certain GPS devices can be plugged in and removed within seconds, so no complicated installations are necessary. And best of all they can be hidden from car thieves. PSA can assist you with how to obtain GPS units at a discounted cost and provide additional information to educate your customers on theft prevention.

- To provide an additional value-added service to your customers, that may also lead to additional business for you, you may choose to provide converter and auto theft prevention information to your clients and arrange an ‘etch and catch’ day at your store for customers.

How to Get Proper Business Insurance Coverage to Protect Your Business?

Comprehensive coverage

Business owners often ask me, “Does insurance cover catalytic converter theft?”. Well, it depends on the insurance policy you have. If none of the above recommendations are an option for your operation, it is important to have proper insurance coverage as a ‘backstop’ to protect your company. Make sure you have comprehensive coverage included in the following policies:

- Garagekeepers Liability – This protects you against damage to your customer’s vehicles that you are responsible for while they are in your care.

- Dealer Open Lot – This provides coverage for the vehicles you are selling on your premises.

- Auto Physical Damage – This coverage is for any owned, loaner, chase, rental, or shop vehicle. Many businesses don’t purchase Comprehensive coverage for older vehicles; however, the premium costs far less than replacing a catalytic converter (not including labor).

Deductible

In the current economy, many business owners are on a mission to keep their business insurance premiums as low as possible. As you know, typically the higher the deductible the lower the premium and vice versa. But you should assess your total cost of risk versus maximum potential out-of-pocket expenses to avoid overpaying. Specifically, if you experience theft of multiple catalytic converters (or any other vandalism or theft claims in general) with a higher deductible to save on premium, there’s a chance you will pay more out-of-pocket replacing the converters than what you would have paid for a higher premium.

Here is an example (numbers are for illustration purposes as rates and premiums vary depending on your state and operation):

- ABC Automotive has a $1,000 per vehicle and $5,000 per event Comprehensive deductible

- The higher deductible saved ABC Automotive $500 in premium

- ABC has 5 catalytic converter claims valued at $1,000 each during a policy period

- Each theft was a separate incident

- Based on the above, ABC spent $5,000 in out-of-pocket expenses in addition to the insurance premium (5 converters x $1,000 = $5,000)

- If ABC had a $250/vehicle deductible, they would have saved $3,750 in out-of-pocket expenses ($250 deductible x 5 claims = $1,250; $5,000 cost of 5 converters – $1,250 cost of 5 converters with lower deductible = $3,750 out-of-pocket costs).

Since every business is different with unique exposures, have a conversation with your insurance broker to ensure your deductible/premium structure is right for your business. This way, you are not overpaying for your total cost of risk while also keeping any out-of-pocket expenses at bay.

Learn More

If you have any questions or wish to discuss how to protect your catalytic converter from theft or evaluate insurance options to best protect your vehicles, please do not hesitate to contact me at pdenobrega@psafinancial.com. If you are an ATI member and need insurance, contact us to get a quote.