On March 11, 2021, President Biden signed the American Rescue Plan Act (ARPA) into law. The $1.9 trillion stimulus law includes several welfare and fringe benefit plan provisions. The information outlined below is subject to clarification as the government agencies issue guidance to implement ARPA.

100% COBRA Subsidy

ARPA provides a 100% premium subsidy for qualified beneficiaries who have lost group health plan coverage due to involuntary termination of employment or reduction in hours. The subsidy applies to both fully insured and self-insured plans (medical, dental and vision) subject to either federal COBRA or state continuation (collectively referred to COBRA below). The subsidy is not available for voluntary termination of employment or for the 36-month COBRA qualifying events

The subsidy period runs April 1, 2021 to September 30, 2021 if the qualified beneficiary does not lose or exhaust COBRA earlier. The subsidy will be available to individuals who:

- are currently enrolled in COBRA

- become eligible for COBRA between April 1, 2021 and September 30, 2021

- became eligible for COBRA prior to April 1, 2021, even if the individual did not elect COBRA when it was initially offered or elected COBRA but later discontinued it

Eligibility for the COBRA subsidy ends when a COBRA participant becomes eligible for other group health plan coverage or Medicare. The individual must provide notice to the employer upon gaining such eligibility.

Contrary to the general COBRA requirement that coverage be continuous, ARPA allows a qualified beneficiary to elect or re-elect COBRA effective April 1, 2021 to take advantage of the subsidy. However, the 18-month maximum continuation period will still be based on the original qualifying event date.

Current COBRA participants and new qualified beneficiaries must be notified of the availability of the subsidy, either as part of the COBRA election notice or in a separate document. Prior qualified beneficiaries must be notified of the extended

election period (for April 1, 2021 coverage date) by May 31, 2021. The election for coverage effective April 1, 2021 must be made within 60 days of receipt of the extended election notice. Additionally, a notice must be sent to COBRA participants between 15 and 45 days prior to the expiration of the subsidy to inform them when the subsidy ends. ARPA directs the Department of Labor to issue model notices within 30 days of enactment (April 10, 2021).

Premiums not paid by COBRA participants who are entitled to the subsidy will be recouped by the applicable entity through a credit against Medicare payroll taxes. For both self-insured and fully insured plans subject to federal COBRA, the employer is the entity entitled to claim the credit. This means that, for fully insured plans, the employer will be responsible for paying the COBRA premium to the insurer and claiming the credit. The credit will include the 2% COBRA administrative charge. For small fully insured plans subject to state continuation only, the insurer is the entity entitled to claim the credit.

Dependent Care Assistance and Tax Credits

For calendar year 2021 only, ARPA amends IRS Code section 129 to increase the limit for employer-provided dependent care assistance (including amounts contributed pretax through a dependent care FSA) from $5,000 to $10,500 (from $2,500 to $5,250 for a separate return by a married individual). This change benefits employees who are carrying over unused DCFSA amounts into 2021 and also re-elected DCFSA in 2021, since they will not be taxed on DCFSA reimbursements in excess of $5,000 for 2021.

As a result of this change, employers are permitted, but not required, to amend DCFSA plans to enable employees to increase their elections up to $10,500 for calendar year 2021. While allowing this increase may seem attractive to employers that offer DCFSAs and to their employees who have significant child care expenses, there are some considerations, including:

- coordination of the increased DCFSA elections with amounts carried over into 2021

- impact on nondiscrimination testing results if highly compensated employees disproportionately take advantage of the increased DCFSA limit

- additional administrative burdens for non-calendar year DCFSA plans (since $10,500 can be excluded from income for calendar year 2021, not plan year)

- impact of greater dependent care tax credits – see below

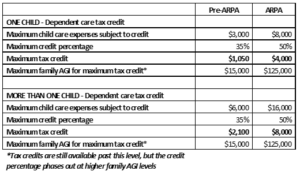

ARPA also greatly expanded the dependent care tax credit as shown below.

As a result of this change, the longstanding comparison between whether the DCFSA or the dependent care tax credit is the “better deal” for employees now has to be reconsidered. Low and middle income employees should be advised to consult their tax advisors to determine, under the revised rules, whether the DCFSA or the dependent care tax credit makes more sense and provides the better tax savings based on their specific situation. If these employees determine that the tax credit is preferable, this could further exacerbate the nondiscrimination testing concern discussed above.

Further Extension of Tax Credits for Voluntary FFCRA Paid Leave

Tax credits for voluntary continuation of EPSL and EFMLA will be available through September 30, 2021. In addition there have been several modifications to EPSL and EFMLA as follow:

- the 10-day limit for EPSL is reset as of April 1, 2021

- use of EPSL is expanded to include paid leave for an employee to: get and wait for the results of a COVID test if exposed or if requested by an employer; get a COVID vaccine; and recover from adverse reactions to a vaccine

- EFMLA may now be used (and tax credits claimed) for all of the qualifying uses of EPSL

- total tax credit for EFMLA is increased to $12,000

- EPSL and EFMLA must be made available on a nondiscriminatory basis for an employer to be eligible for tax credits